China's Generation Z: Understanding the Impact of Generation Z in Chinese Market

China’s Generation Z, also known as the “00s” or “post-2000s” generation, represents a cohort of young individuals who have grown up in an era of technological advancements and rapid economic development. This article provides key insights into the Generation Z population based on QuestMobile’s 2023 report. The following is an overview of the findings.

Key Findings:

- Profile of Generation Z:

- Compared to the previous generation (the 90s), Generation Z exhibits stronger characteristics in digital technology due to growing up in an environment permeated by digital advancements.

- There are nearly 150 million active online users from Generation Z, with a higher proportion of female users. Users from first-tier, new first-tier, and second-tier cities account for a significant percentage.

- On average, Generation Z spends 173.2 hours per month using mobile apps, significantly higher than the overall average. They heavily rely on the internet and display high activity levels throughout the day, with over 30% of users remaining active even after midnight.

- In terms of smartphone preferences, mid-to-high-end models priced between 2000-4999 RMB are the mainstream choice. Female Generation Z users tend to prefer brands like OPPO and Vivo, while male users show a preference for Apple, Huawei, and Xiaomi.

- They exhibit a strong interest in influencer content and are willing to share. They also show clear preferences for domains like food, gaming, and music.

- The behaviour of Generation Z in the Digital Space:

- Generation Z covers various life stages, including education, early career, and relationships, leading to the use of multiple applications catering to their diverse needs.

- They actively engage with learning apps, including course study, question bank searches, and vocabulary memorization. University course apps like Xuexi Tong and NetEase Youdao Dictionary are particularly popular among Generation Z.

- Knowledge experts from different fields who share their expertise through content platforms are also popular among Generation Z users. The convenience of the internet has played a significant role in shaping their knowledge systems. Content focuses on extracurricular Chinese language tutoring, math explanations, and digital technology-related self-media.

- As Generation Z enters the competitive job market, job search and recruitment activities have increased. Additionally, there is a relatively high interest in civil service exams in lower-tier markets.

- Digital office tools have become a part of Generation Z’s daily work activities, with over 78 million users utilizing business and office apps. They clearly prefer productivity, electronic document management, and cloud storage applications. Examples include DingTalk, Baidu Netdisk, WeChat Work, and Feishu.

- Growing up in the digital age, Generation Z emphasizes building social networks based on their interests. Thus, platforms with community attributes are highly favoured. They enjoy expressing themselves, following fashion trends, and sharing experiences with like-minded individuals. Female users tend to prefer apps like Weibo, Xiaohongshu, and Zhihu, while male users lean towards Baidu Tieba and Tantan.

- Generation Z’s top five active short-video apps include Douyin, Kuaishou, Kuaishou Lite, Douyin Lite, and Xigua Video. In the online video industry, the top three apps are iQiyi, Tencent Video, and Bilibili.

- Online Consumption Trends of Generation Z:

- Generation Z is the driving force behind digital shopping in China, with higher frequency and spending compared to other age groups. Mobile shopping has become their primary mode of consumption.

- Online shopping platforms serve as the main places for Generation Z to explore fashion, purchase trendy products, and share shopping experiences. They seek shopping inspiration and product information through social media, live streaming, and short videos.

- Generation Z has higher expectations for brand and product personalization and innovation. They value personalized experiences and emotional value in their shopping journeys. Personalized recommendations and customized services can attract and retain their attention.

- Social e-commerce is popular among Generation Z. They enjoy shopping through social media platforms, sharing their buying experiences with friends, and even becoming store owners on social e-commerce platforms.

- Generation Z has a higher level of concern for environmental protection and sustainable development. They are inclined to purchase green products and support environmentally responsible brands. Brands’ social responsibilities and sustainability efforts are important factors influencing their purchasing decisions.

China’s Generation Z represents a digitized generation that displays distinct characteristics in the digital realm, heavily relying on the internet and mobile applications. For marketers, understanding their characteristics and behaviours will help in better targeting and appealing to this young and active consumer group. Remember, understanding the unique characteristics and behaviours of Generation Z is crucial for success in the Chinese market. Act now to tap into the vast opportunities presented by this young and influential consumer segment.

For further insights and customized recommendations on effectively targeting and engaging with China’s Generation Z, contact us to find out more.

Insights into 2023 China's "520" Valentine's Day Consumer Behavior: Trends and Analysis

“520 Valentine’s Day,” a virtual holiday created by millions of Chinese netizens, differs from the traditional Qixi Festival. On this special day, consumer enthusiasm for shopping soars. To understand their needs and preferences, iiMedia Research conducted a nationwide random sampling survey titled “China’s ‘520’ Romantic Economic Consumer Behavior Insights Data.”

Consumer Market Size and Profile:

According to the survey data, over 90% of respondents expressed willingness to make purchases and give gifts to loved ones on this holiday, regardless of being single, in a relationship, or married. This shows the impact of online Valentine’s Day on the consumer market. The data reveals that China’s gift economy market size has grown from ¥800 billion in 2018 to ¥1.2262 trillion in 2022, with a consistent upward trend. It is projected to reach ¥1.3777 trillion by 2024 and ¥1.6197 trillion by 2027.

The data also indicates that the gift purchase budgets for Valentine’s Day show a certain distribution pattern: approximately 27.40% of consumers set their gift budgets between ¥500-999, while 20.12% of respondents have budgets ranging from ¥1000-1999. Overall, consumers’ budgets tend to be concentrated at a moderate level.

Furthermore, this year’s 520 Valentine’s Day primarily targets the age group of 31-40, with 45.40% of respondents setting their gift budgets between ¥1000-4999. Individuals in this age range are typically in relatively stable life and work stages, possessing independent purchasing power and strong economic capacity. Therefore, compared to the price of the gift, they prioritize personal preferences and product quality.

Gift Types and Purchase Channels:

The survey also found that over 80% of consumers hope to receive gifts on “520” day, and nearly 70% of consumers prepare gifts for their partners. Male consumers focus more on their partners’ preferences, while female consumers value the practicality of the gifts. In terms of gift choices, consumers tend to purchase beauty and skincare products, jewellery, electronics, home goods, and fashion items. These data reflect Chinese consumers’ pursuit of quality and personalized gifts, showcasing market opportunities for related industries during the online Valentine’s Day period.

Moreover, the survey shows that over half of consumers prefer online shopping, mainly through e-commerce platforms and social media such as JD.com, Taobao, Xiaohongshu, and WeChat, along with some utilizing short-video e-commerce platforms. Offline shoppers, on the other hand, tend to choose shopping malls, speciality stores, and department stores. This highlights the significant role played by both online and offline channels during the online Valentine’s Day, as consumers explore and purchase desired gifts through various avenues.

Ritualistic Self-Gifting for Singles:

During Valentine’s Day, single individuals have emerged as an emerging consumer group. They choose to invest more time and money in self-improvement and cultivating hobbies. This consumer trend drives the development of markets such as pet products and solo dining. Among them, 50.54% of single individuals choose to buy gifts for themselves or someone they like, while 45.16% of singles participate in shopping discount activities. In recent years, with the rise of singlehood, the consumption demands of single individuals have continued to increase. China has a population of 240 million singles, who seek self-fulfilment and enjoyment in material and entertainment aspects.

Conclusion:

Based on this survey data, it is evident that the “520” Valentine’s Day has become a significant milestone in China’s consumer market. Whether expressing emotions, deepening relationships, or fulfilling personal desires, this unique virtual holiday brings more consumer enjoyment and romantic experiences to the Chinese people. Consumers purchasing gifts through online and offline channels exhibit personalized and diversified consumption trends, offering tremendous business opportunities and development space for related industries.

Act now to unlock the potential of this significant consumer segment. To obtain further insights and personalized recommendations on leveraging the opportunities presented by the “520” Valentine’s Day in China, contact us now.

Reaching Chinese Tourists and Travelers: Unlocking Marketing Opportunities with China Online Travel Platform Tuniu

Established in 2006, Tuniu has emerged as a prominent online travel agency in China, revolutionizing the way people plan and book their trips. With its comprehensive range of travel services and advanced technology, Tuniu offers a platform for businesses to tap into the lucrative Chinese travel market. From understanding Tuniu’s user portrait to exploring the advertising collaboration options, this guide will equip you with the knowledge to optimize your brand exposure within the Chinese travel market.

User Portrait

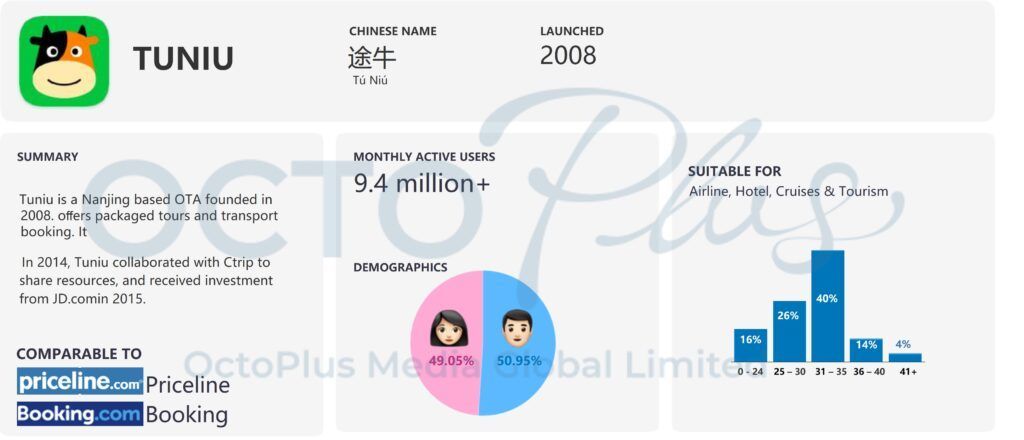

To effectively utilize Tuniu’s advertising potential, it is crucial to understand its user portrait. Tuniu boasts an impressive monthly active user base of 9.4 million, representing a vast audience of travel enthusiasts.

Tuniu caters to diverse users, including adventure seekers, family vacationers, and luxury travellers. Its user base consists of tech-savvy individuals who rely on online platforms to plan and book their trips. This demographic typically seeks authentic travel experiences, unique accommodations, and customized itineraries.

- Age Range: Tuniu attracts a broad range of users, predominantly between 25 and 35 years old, encompassing young professionals and families seeking travel experiences.

- Tech-Savvy Audience: Tuniu’s users are tech-savvy individuals who prefer the convenience of planning and booking their trips online, leveraging the platform’s advanced features and mobile app.

Advertising Opportunity

Tuniu offers diverse advertising opportunities that allow businesses to promote their products and services to a wide range of travel enthusiasts. Let’s explore the key advertising options available:

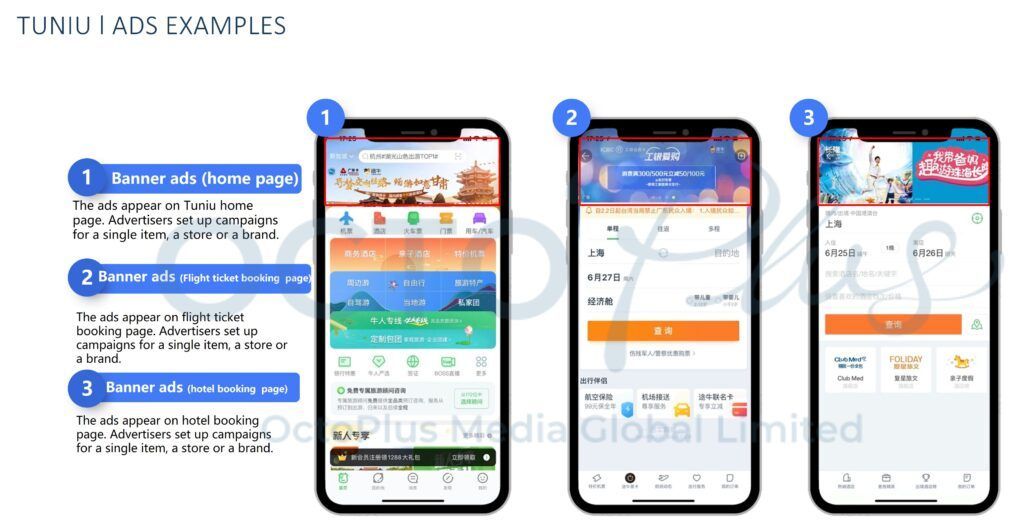

- Display Ads: Take advantage of prominent ad placements on Tuniu’s website and mobile app to increase your brand visibility. Craft visually appealing display ads with compelling visuals and engaging copy to capture the attention of potential customers.

- Native Ads: Seamlessly integrated within Tuniu’s content, native ads provide a non-intrusive way to engage users. Create native ads that blend seamlessly with the platform’s interface, enhancing user experience and boosting brand awareness.

- Sponsored Listings: Opt for sponsored listings on Tuniu to ensure your products or services appear at the top of relevant search results. This increased visibility enhances your chances of attracting conversions and bookings.

- Social Media Promotions: Leverage Tuniu’s strong social media presence to reach a broader audience. Collaborate on sponsored posts across platforms such as WeChat and Weibo, tapping into Tuniu’s extensive user base and increasing your brand’s visibility.

Advertising Collaboration

Tuniu offers collaborative opportunities that foster mutually beneficial partnerships. Consider the following collaboration options:

- Package Deals: Collaborate with Tuniu to create enticing travel packages that feature your products or services. This partnership not only increases brand exposure but also allows you to tap into Tuniu’s substantial customer base.

- Content Collaboration: Join forces with Tuniu to create compelling travel-related content, such as articles, videos, or destination guides. Aligning your brand with Tuniu’s industry authority enhances your brand’s credibility and attracts a larger audience.

- Exclusive Discounts: Offer exclusive discounts or perks to Tuniu users to incentivize bookings and cultivate customer loyalty. This collaboration benefits both parties, as Tuniu’s users enjoy added value, while your business gains exposure and increased sales.

Tuniu, presents an array of advertising opportunities for businesses seeking to maximize their brand exposure in the Chinese travel market. By understanding Tuniu’s user portrait, businesses can tailor their advertising strategies to resonate with the platform’s diverse user base. Whether through display ads, native ads, sponsored listings, or collaborative efforts, Tuniu offers a platform for brands to reach millions of travel enthusiasts. Embrace the advertising opportunities that Tuniu provides, and unlock the potential for growth and success in China’s bustling travel industry. Contact us to find out more about Tuniu advertising opportunities.

-End of the Newsletter-

Feel free to talk to us

It’s a team with one single shared goal, which is our client’s success. Deliver results for your business now.