Medical Aesthetics Whitepaper: Xiaohongshu Marketing Insights

OctoPlus Media released a professional whitepaper provides an in-depth analysis of China’s medical aesthetics market growth trends, consumer behavior, and Xiaohongshu marketing strategies, offering brands guidance for success in China Market.

How to Stand Out in China's Medical Aesthetics Market Using Xiaohongshu Marketing Strategies

In recent years, Xiaohongshu has emerged as a crucial marketing platform for the medical aesthetics industry in China due to its unique user base and community culture. Hence, OctoPlus Media has released a whitepaper analyzing the application of Xiaohongshu in the medical aesthetics industry, highlights successful case studies, and also addressing the challenges and strategies for operating medical aesthetics brands on Xiaohongshu.

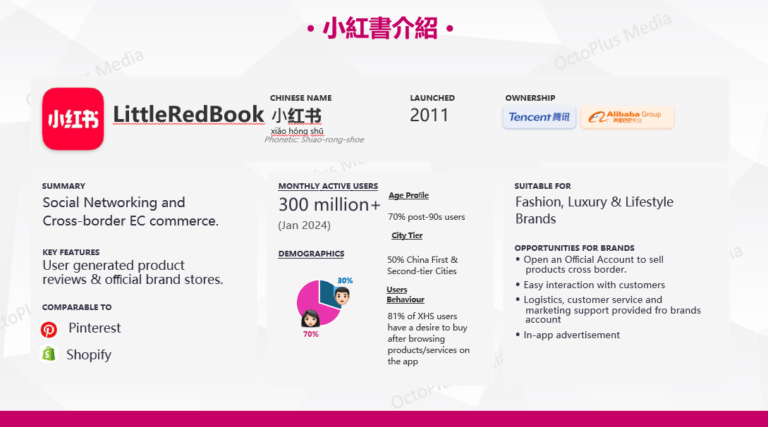

Introduction of Xiaohongshu

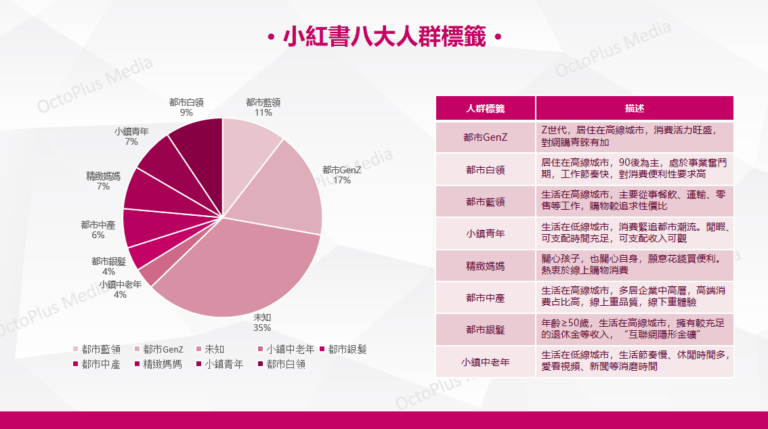

Since its launch in 2011, Xiaohongshu has rapidly grown into one of the most popular social platforms among mainland Chinese users, especially in the fashion, luxury, and lifestyle sectors. With an 80% market share in China, Xiaohongshu is a key channel for brands entering the Chinese market. According to demographic analysis, Xiaohongshu’s user base can be categorized into eight major segments: Urban Gen Z, Urban White-Collar Workers, Urban Blue-Collar Workers, Small-Town Youth, Elegant Moms, Urban Middle Class, Urban Seniors, and Small-Town Middle-Aged and Elderly.

(eight key demographic segments on Xiaohongshu)

The Importance of Xiaohongshu in China's Medical Aesthetics Market

In China’s medical aesthetics market, it is important to choose the right platform for marketing and promotion. Xiaohongshu, with its unique blend of social media and e-commerce, has become the preferred platform for many medical aesthetics brands. Whether it’s brand exposure, user engagement, or sales conversion, Xiaohongshu offers unparalleled advantages. Its user base is highly attentioned to new trends and has fostered a unique “planting grass” culture, where many emerging brands and products gain market recognition and popularity through Xiaohongshu.

Why Must Medical Aesthetics Brands Choose Xiaohongshu?

- Massive User Base: Xiaohongshu boosts over 300 million monthly active users, 70% of whom are young people born in the 1990s, particularly concentrated in China’s firstand second-tier cities (accounting for 50%). This demographic not only has strong purchasing power but also shows a high acceptance of medical aesthetics services.

- High User Activity: A 2023 survey on Xiaohongshu usage frequency in China reveals that over 80% of users engage with the platform daily, and more than 50% use it multiple times a day. This indicates Xiaohongshu’s large user base and high user stickiness.

- High User Trust: Research shows that 72% of Xiaohongshu users trust the content on the platform, 59.2% find the “planting grass” content detailed and credible, and 51.9% consider product reviews to be authentic and reliable. This level of trust directly influences users’ purchasing decisions, making Xiaohongshu the best platform for brands to build consumer trust.

- HugeContent Ecosystem: Xiaohongshu has over 80 million content creators, with a daily search penetration rate of 60%. 90% of the content on the platform is user-generated (UGC), which adds to the authenticity and interactivity of the content. Brands can leverage genuine user experiences, indicating that Xiaohongshu possesses a vibrant content ecosystem.

- Precise Marketing Targeting: Xiaohongshu users often rely on searches to obtain in-depth information and make purchasing decisions. Brands can take advantage of this by creating content and targeted advertisements to precisely reach their target audience.

Differences Between Xiaohongshu and Instagram

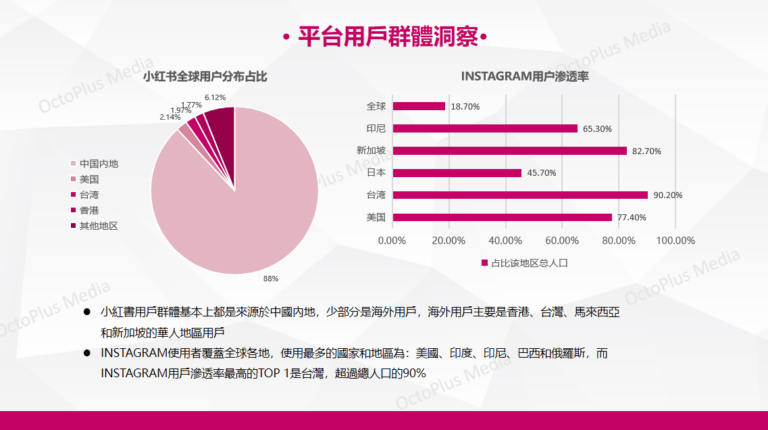

- Instagram: Instagram has a global user base, with the most active users located in the United States, India, Indonesia, Brazil, and Russia. Taiwan has the highest Instagram penetration rate, with over 90% of the population using the platform. Instagram primarily focuses on visual appeal, and users often discover and engage with brands through exploration and discovery features.

- Xiaohongshu: Xiaohongshu’s user base is primarily concentrated in mainland China, with a smaller segment of overseas users, mainly from Hong Kong, Taiwan, Malaysia, and Singapore. Xiaohongshu places a stronger emphasis on interest-based content discovery (“planting grass”) and community interaction, particularly through its search functionality, which allows for in-depth information retrieval. This gives Xiaohongshu a unique advantage in shaping brand perception and driving purchase decisions.

*The whitepaper will further explore the similarities and differences between Xiaohongshu and Instagram users, as well as compare the marketing effectiveness of the two platforms.

(Insights into User Demographics on Xiaohongshu and Instagram)

China's Medical Aesthetics Market: Size and Growth Trends

- Market Expansion: According to the 《2023 China Medical Aesthetics Industry Insight Report》,the overall size of China’s medical aesthetics market has exceeded 200 billion RMB and is expected to maintain double-digit annual growth rates in the coming years. With an increasing willingness among consumers to invest in personal appearance, the market’s potential is huge.

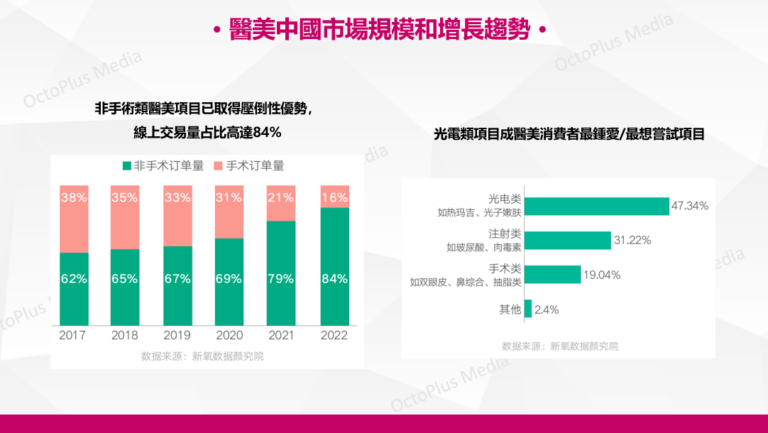

- Dominance of Non-Surgical Procedures: Non-invasive procedures, particularly energy-based treatments such as laser and radiofrequency therapy, are the most popular in China’s medical aesthetics market. These treatments are favored for their minimal invasiveness and quick recovery, accounting for 84% of online transactions.

- Emergence of the “Mature” User Group: Consumers aged 26 and above now make up more than 50% of paying users, becoming the main force in China’s medical aesthetics market. This age group is particularly focused on anti-aging and facial rejuvenation, with higher consumption frequency and spending per session.

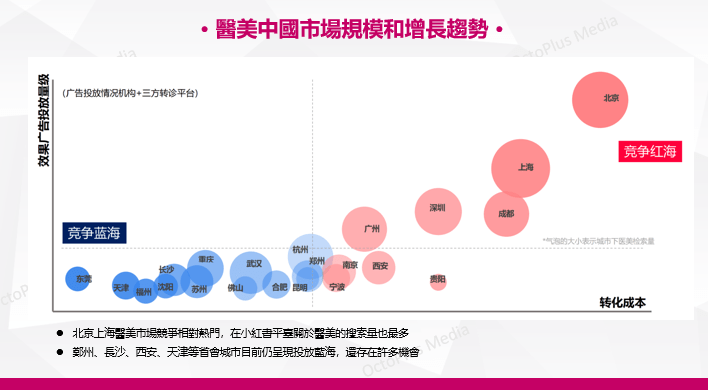

- Significant Regional Differences: First-tier cities like Beijing and Shanghai remain competitive hotspots in China’s medical aesthetics market. However, provincial capitals such as Zhengzhou, Changsha, Xi’an, and Tianjin are showing high growth potential and remain relatively untapped markets. These second- and third-tier cities are becoming crucial battlegrounds for brand expansion.

- Rising Demand for Overseas Medical Aesthetics: Among those who had or are considering medical aesthetic procedures in 2022 and 2023, 16% expressed a desire to seek treatments abroad, with Hong Kong, Macau, Taiwan, Japan, and South Korea being the preferred countries.

(The Size and Growth Trends in China’s Medical Aesthetics Market)

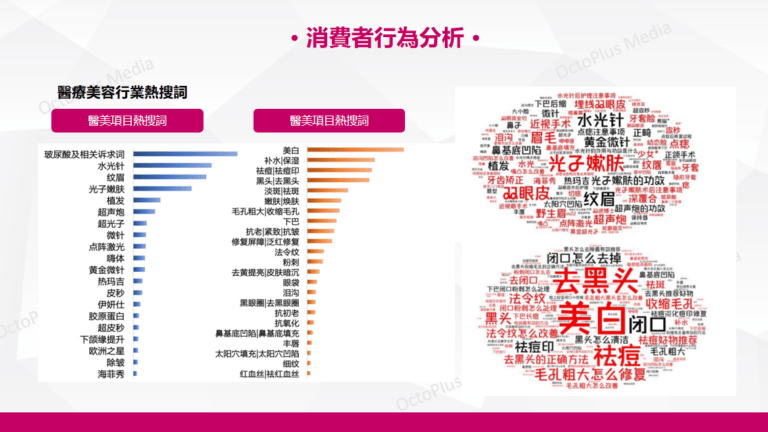

Analysis of Consumer Behavior in China’s Medical Aesthetics Market

- Top Searched Keywords: The most searched keywords in the medical aesthetics market often highlight consumer interests, such as “photorejuvenation,” “whitening,” “hyaluronic acid,” “skin boosters,” “laser freckle removal,” and “minimally invasive procedures.” These treatments are typically entry points for consumers new to medical aesthetics.

- Impact of “Planting Grass” Culture: The active “planting grass” culture on Xiaohongshu plays a crucial role in spreading information about medical aesthetic procedures. Users share their personal experiences, especially before-and-after photos, which serve as valuable references for others making decisions.

- High Trust in UGC Content: Medical aesthetics consumers tend to trust real experiences shared by ordinary users over official brand promotions. Data shows that 72.0% of Xiaohongshu users trust the quality of the platform’s content, and 51.9% find product reviews to be credible and authentic.

- Complex Decision-Making Process: When deciding whether to undergo a medical aesthetic procedure, consumers typically conduct extensive online research, comparing the reputation, prices, and safety of different brands and procedures. This behavior underscores the importance of Xiaohongshu as a key platform for shopping decisions.

- Young Users Value Personalized Experiences: Young consumers seeking personalized aesthetic experiences are more willing to try emerging medical aesthetic procedures, such as injectable treatments and skincare management. This group tends to have high brand loyalty and eagerly shares their experiences on social platforms.

Case Study: A Successful Path from Strategy to Practice

1. DR REBORN: Deep Exploration of Matrix-Based Operations

DR REBORN is a well-known medical aesthetics brand under Hong Kong’s EC Healthcare. They adopted a matrix-based operational strategy, which involves registering multiple official accounts targeting different segments of the medical aesthetics market (such as medical beauty, eye care, slimming, etc.). This approach not only increased the brand’s reach but also attracted diverse user groups with content tailored to their specific needs.

- Precise Market Segmentation: DR REBORN uses multiple segmented accounts to post targeted content, ensuring that each account attracts the most relevant audience. For example, their content related to medical beauty focuses more on educational information and promotions, while the eye care account emphasizes user experience sharing.

- Collaboration with Greater Bay Area Influencers: DR REBORN collaborated with influencers from the Greater Bay Area on Xiaohongshu, inviting them to visit their stores and share their experiences. This online-to-offline approach significantly enhanced brand interaction and increased trust among mainland Chinese users, encouraging more to visit Hong Kong for treatments.

2. NEW BEAUTY: The Success of Brand Exposure through Influencer Collaborations

NEW BEAUTY, a medical aesthetics brand under Hong Kong Perfect Medical Group (formerly known as Fit Body Centre), also employs a matrix-based operational strategy by registering independent official accounts for different medical aesthetics services and collaborating with influencers for brand promotion.

- Influencer Store Visits: NEW BEAUTY collaborated with influencers from the Greater Bay Area, inviting them to visit and experience body slimming and body management services, and share their genuine feedback on Xiaohongshu. These store visits not only increased brand exposure but also built brand reputation through authentic user experience sharing.

- Strengthening Multi-Channel Interaction: NEW BEAUTY enhanced user engagement by leaving comments on influencer posts, directing users to message the brand’s official account. This strategy significantly boosted user participation and interaction with the brand, leading to increase conversions.

3. LUXMED: Efficient Strategy Combining Comment Section Guidance and Private Traffic Management

LUXMED, a brand under Hong Kong Hearts Medical Group, is still in the early stages of Xiaohongshu operations but has successfully increased brand exposure by collaborating with KOLs/KOCs from the Greater Bay Area. They also used a comment section guidance strategy to drive in-store conversions.

- KOL/KOC Collaborations: By working extensively with KOLs and KOCs from the Greater Bay Area, LUXMEDgained widespread brand exposure on Xiaohongshu. In the comment sections, Luxmed guided users to add customer service WeChat accounts, facilitating smooth online-to-offline conversions. This approach not only enhanced user trust but also increased brand interaction.

- Efficient Private Traffic Management: LUXMEDcollected potential customer information on Xiaohongshu and quickly channeled these users into their private traffic for further consultation and conversion. This method not only increased user retention but also effectively boosted sales conversions.

Challenges and Strategies for the Medical Aesthetics Industry on Xiaohongshu

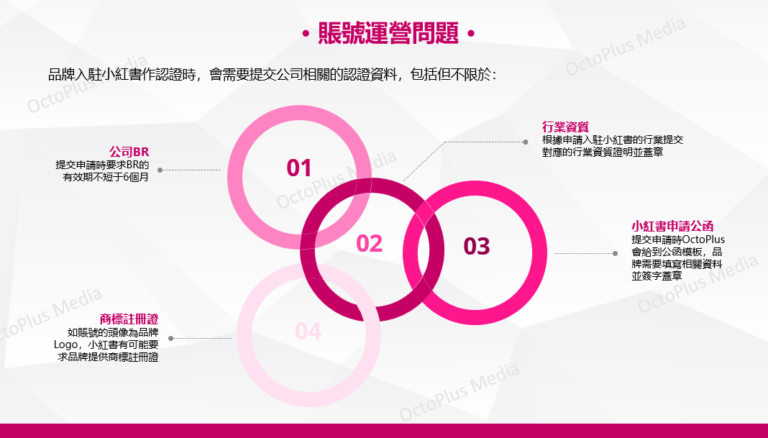

1.Qualification Certificate Requirements

Xiaohongshu has strict account certification requirements for the medical aesthetics industry, especially for medical beauty projects. When applying for official certification, brands must submit the following key credentials:

- Industry Qualification Certificates: Brands must submit relevant industry qualification certificates with official seals, corresponding to thesector they are applying to join on Xiaohongshu.

- Business Registration License (BR): A valid business registration license with at least six months of validity must be submitted during the certification process. This license must be accurate and include the company’s latest registration information.

- Trademark Registration Certificate: If the account uses the brand’s logo as the profile picture, Xiaohongshu may require a trademark registration certificate to ensure the legality of the logo.

- Xiaohongshu Application Letter: OctoPlus will provide a template for the application letter when submitting the certification request. The brand must fill in the relevant details and have it signed and stamped.

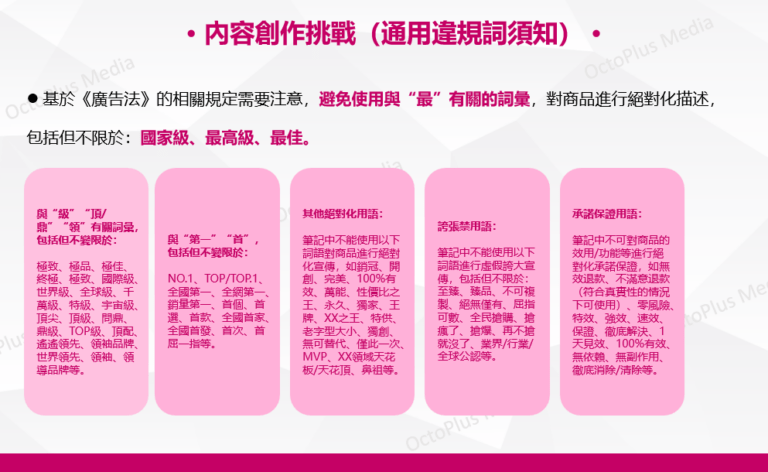

2. Challenges in Content Creation

Content creation in the medical aesthetics industry faces significant challenges, primarily due to advertising compliance and the strict regulations imposed by the platform:

- Restrictions on Describing Special Effects: For content related to medical aesthetics and health products, Xiaohongshu prohibits the direct use of certain terms that describe specific effects. For example:

- Whitening and Spot Removal: Avoid using terms like “fade spots,” “whitening,” “brightening,” “remove dark spots.”

- Hair Growth and Hair Loss Prevention: Avoid terms like “strengthen hair,” “prevent hair loss,” “increase hair volume,” “reduce hair shedding.”

- Deodorization: Avoid using terms like “eliminate odors,” “remove body odor,” “inhibit underarm odor.”

Therefore, brands can creatively use pinyin, punctuation, emojis, or homophones to circumvent these restrictions while maintaining the attractiveness of the contents.

- Prohibition on Absolute Terms: The following types of language are strictly forbidden in contentoutlined by the 《Advertising Law》:

- Superlative Terms: Words like “highest,” “best,” “most effective,” etc., are not allowed.

- “First” Terms: Phrases such as “number one online,” “best-seller,” “first choice,” etc., are prohibited.

- Absolute Claims: Descriptions like “100% effective,” “permanent,” “exclusive,” etc., are banned.

- Words Related to “Ultimate”: Terms like “ultimate,” “supreme,” “top-grade,” “optimal,” etc., are restricted.

- Guarantee Promises: Content cannot include absolute guarantees about a product’s efficiencyor function, such as “money-back guarantee,” “satisfaction guaranteed,” etc.

- Exaggerated Language: Phrases like “exquisite,” “premium,” “irreplaceable,” “one-of-a-kind,” etc., are prohibited as they are considered misleading or overly exaggerated.

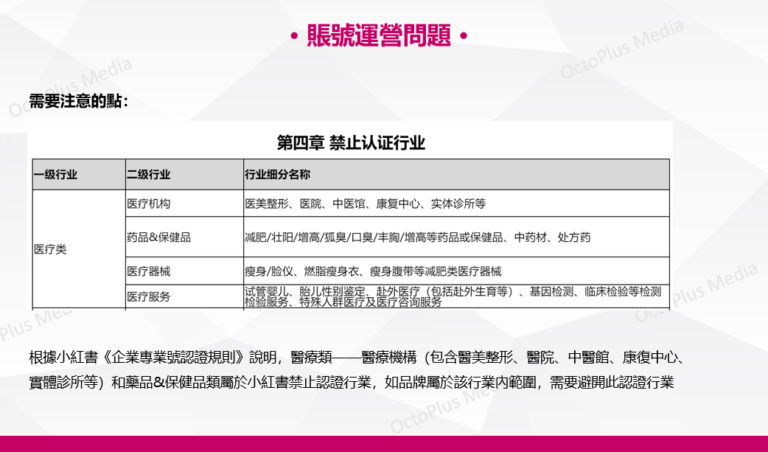

3. Special Regulations on the Medical Aesthetics Industry by Xiaohongshu

According to Xiaohongshu’s《Enterprise Professional Account Certification Rules》, certain categories within the medical field—such as medical institutions, pharmaceuticals, and health supplements—are classified as prohibited industries for certification on the platform. If a brand falls under one of these categories, it must avoid certification on the selected categories. The specific prohibited industries and their subcategories are as follows:

- Medical Institutions: Medical aesthetics and plastic surgery clinics, hospitals, traditional Chinese medicine clinics, rehabilitation centers, physical clinics, etc.

- Pharmaceuticals & Health Supplements: Products related to weight loss, male enhancement, height increase, body odor, bad breath, breast enhancement, height increase, Chinese herbal medicine, prescription drugs,

- Medical Devices: Weight loss devices, face slimming devices, fat-burning slimming clothes, slimming belts, and other weight loss medical devices.

- Medical Services: Services related to in vitro fertilization, fetal gender determination, medical tourism (including giving birth abroad), genetic testing, clinical testing, and monitoring services, special population medical services, and medical consultation services.

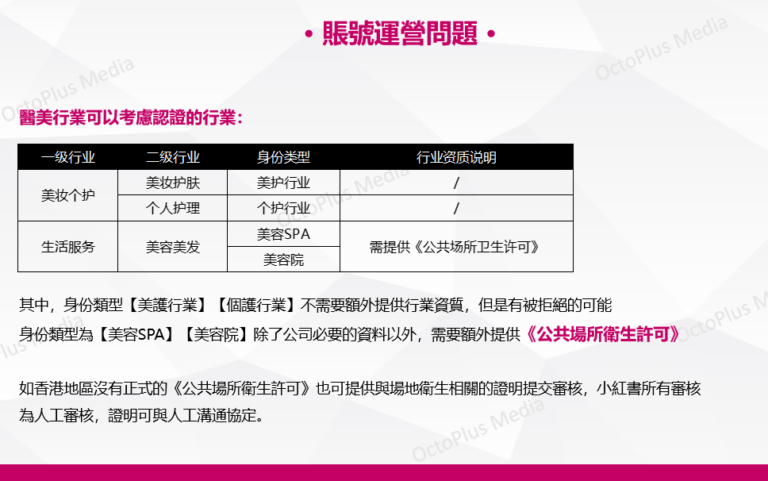

For the medical aesthetics industry, the acceptable certification categories include:

- Beauty and Personal Care:

- Beauty and Skincare: Classified under the beauty care industry.

- Personal Care: Classified under the personal care industry.

- Lifestyle Services:

- Beauty and Hairdressing: Classified into two types: Beauty SPA and Beauty Salon.

Among these, the classifications of【Beauty Care Industry】and【Personal Care Industry】do not require additional industry qualifications but may still face rejection. For the classifications of【Beauty SPA】and【Beauty Salon】, in addition to the necessary company documents, an 《Public Health License》 is required. If the Hong Kong region does not have a formal 《Public Health License》, other hygiene-related certifications may be provided for review. All certifications are subject to manual review by Xiaohongshu, and the evidence can be discussed and agreed upon with a reviewer.

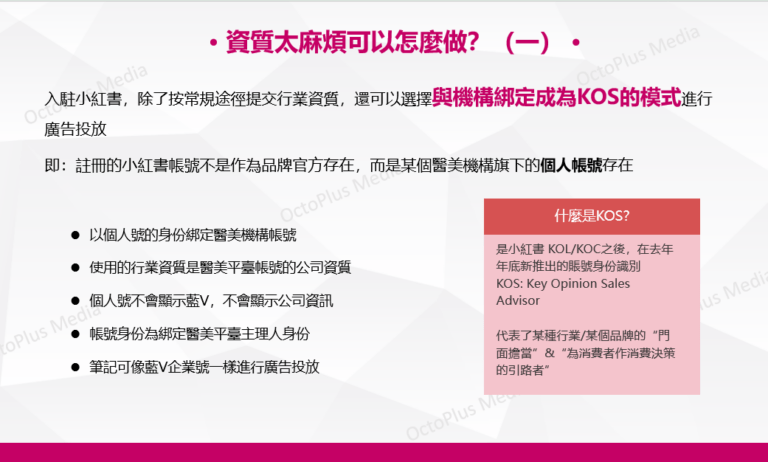

For brands in the prohibited categories, alternative approaches to entering Xiaohongshu could include collaborating with legally certified institutions or adopting a KOS (Key Opinion Seller) model.

4.Strategies for Overcoming Certification Challenges

KOS Model (Key Opinion Sales Advisor): Brands can register a personal account under a medical aesthetics institution (KOS) and link it to the institution’s company credentials. This approach simplifies the complex enterprise certification process and avoids certification failures due to insufficient qualifications. KOS accounts have the following features:

- No Blue Verification Badge: Personal accounts do not display the enterprise blue V badge or publicly show company information, offering greater operational flexibility.

- Advertising Capabilities: KOS accounts can place ads just like blue V enterprise accounts, helping brands increase their visibility.

Creating a Doctor’s Personal IP Account: By developing a professional doctor’s personal IP account, brands can effectively enhance user trust in their services. These accounts are typically run by the doctors themselves, who share educational content and insights into medical aesthetics. This approach attracts user attention and allows for direct advertising.

How Can the Medical Aesthetics Industry Promote on Xiaohongshu?

- Stay Aligned with Industry Trends and Amplify User Interests

Users in the medical aesthetics industry often focus on aspects such as the effectiveness of treatments, reasonable pricing, and service quality. Brands can increase user trust and follower loyalty by continuously tracking industry trends and creating content that addresses these concerns, such as sharing success stories, educating users on medical aesthetics, and showcasing genuine user feedback. - Combine Precise Ad Targeting with Private Traffic Management

Xiaohongshu’s platform characteristics allow for highly targeted ad placements. Brands can use data analysis to accurately target their desired audience and deliver tailored ads. Additionally, effectively utilizing private traffic by guiding potential customers from Xiaohongshu to platforms like WeChat for further consultation and sales can significantly enhance overall conversion rates. - Multi-Dimensional Content Creation to Enhance Brand Value

On Xiaohongshu, the diversity and authenticity of content are key to attracting users. Brands can create a rich content matrix by combining user-generated content (UGC), expert KOL insights, and official brand educational content, thereby enhancing their professional image and building user trust.

Conclusion

As an essential social e-commerce platform in the Chinese market, Xiaohongshu offers vast marketing opportunities for the medical aesthetics industry. By effectively leveraging the platform’s user base and community culture, medical aesthetics brands can achieve dual goals of brand exposure and user conversion. However, brands must navigate challenges related to certification and content creation. Moving forward, medical aesthetics companies should continue to refine their Xiaohongshu marketing strategies to enhance brand influence and further expand their market share.

Get Our Xiaohongshu Marketing Whitepaper for the Medical Aesthetics Industry and Master More Techniques Now!

This article has provided you with core strategies and case studies on how to succeed in the medical aesthetics market using Xiaohongshu. If you want to delve deeper into practical techniques, the latest market trends, and how to apply these strategies to your brand, please leave your details below. We will send you the 《Xiaohongshu Marketing Strategies and China Market Insights for the Medical Aesthetics Industry》whitepaper to help your brand stand out in China’s medical aesthetics market!

(The report is written in Chinese)

Feel free to talk to us

It’s a team with one single shared goal, which is our client’s success. Deliver results for your business now.